Good morning.

Tuesday in Whitewater will be partly sunny with a high of forty-eight. Sunrise is 7:10 AM and sunset 6:58 PM, for 11h 47m 27s of daytime. The moon is a waxing crescent with 30% of its visible disk illuminated.

Today is the eight hundred fifty-third day.

Whitewater’s Public Works Committee meets at 6 PM.

On this day in 1933, Pres. Roosevelt gives his first Fireside Chat on the radio:

a series of 30 evening radio addresses given by U.S. President Franklin D. Roosevelt (known colloquially as “FDR”) between 1933 and 1944. Roosevelt spoke with familiarity to millions of Americans about the promulgation of the Emergency Banking Act in response to the banking crisis, the recession, New Deal initiatives, and the course of World War II.

See also text of Fireside Chat, ‘On the Bank Crisis.’

Recommended for reading in full:

Kate Rabinowitz and Kevin Uhrmacher report What Trump proposed in his 2020 budget:

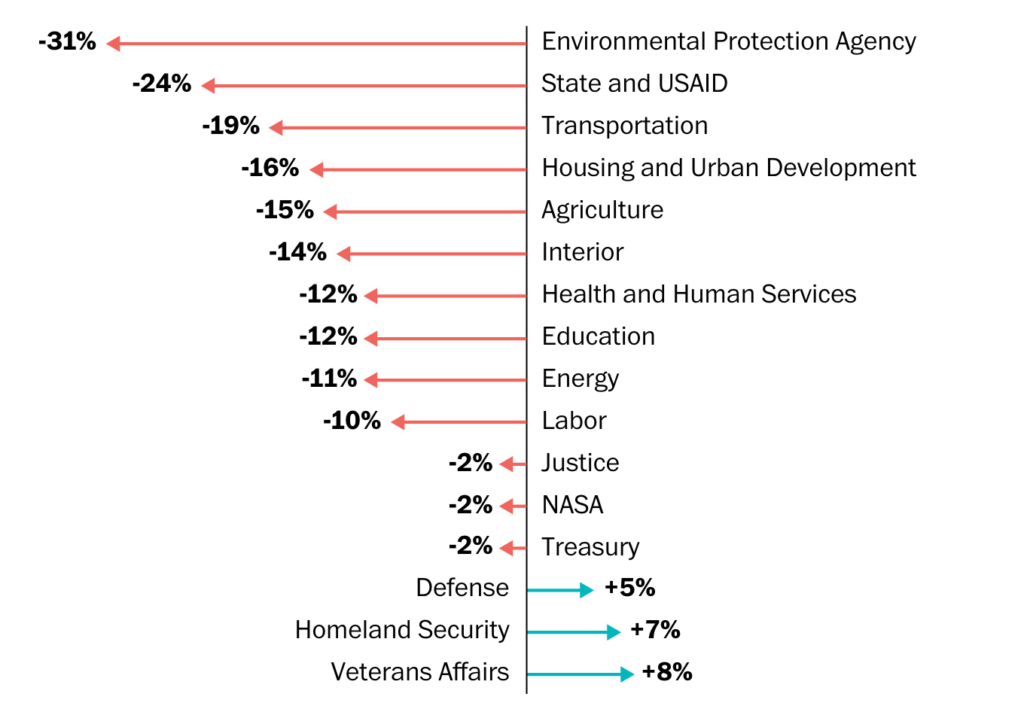

The Trump administration released its 2020 budget request on Monday, proposing major cuts to federal government spending. While the cuts are unlikely to become reality — Congress has rejected many of Trump’s previous requests — the budget is an important signal of the administration’s priorities and suggests a major funding fight in October.

Proposed changes to funding in Trump’s budget

In the document, Trump calls for large budget increases to defense and border security alongside substantial cuts to government benefits. Trump’s budget proposal for the last fiscal year similarly proposed increased defense spending and cuts to other departments. Congress did not act on many of his recommendations. The budget is likely to face even more of an uphill battle with Democrats now in control of the House.

William Gale contends The tax cuts will make fighting future recessions complicated:

the 2017 tax cuts made several changes that significantly reduce the ability to offset the business cycle. First, the corporate income tax rate was reduced from 35 percent to 21 percent. Corporate income tends to soar in booms and plummet in recessions, so lower rates mean that revenues will not adjust as much to our highs and lows in the economy. The tax cuts also reduced rates for income from wages and pass through businesses. As a result, when income falls in a future recession, taxes will fall by less than they otherwise would have.

Next, the tax cuts limits the use of net operating losses. Under prior law, firms losing money owed no income tax for the current year, and they could obtain cash refunds for taxes paid in the previous two years. Firms used this provision more in recessions than in booms, and it served as an automatic stabilizer. To stimulate the economy after the financial crisis, Congress temporarily expanded the carryback period for net operating losses to five years. The 2017 tax cuts, however, repealed carrybacks of losses for most businesses. As a result, as income turns down in a future recession, firms with losses will no longer be able to claim refunds for previous tax payments and therefore will face tighter cash constraints.